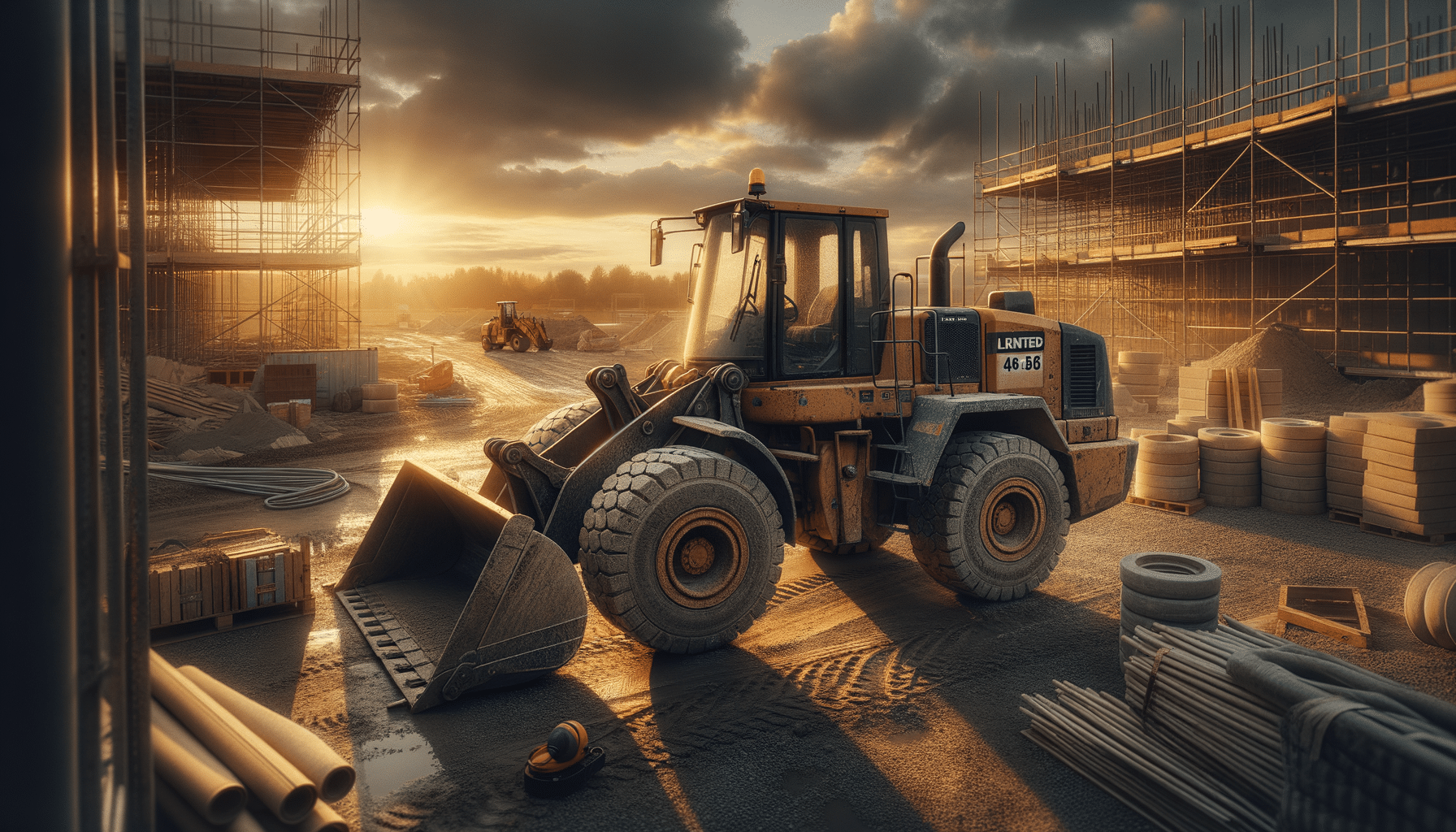

Exploring Rent To Own Loaders: A Comprehensive Guide

Introduction to Rent To Own Loaders

In today’s dynamic construction and agricultural industries, acquiring heavy machinery can be a substantial investment. As businesses strive to optimize operations while managing budgets, rent-to-own loaders have emerged as a viable solution. This option combines the flexibility of leasing with the eventual ownership, offering a strategic approach to equipment acquisition. Understanding the nuances of this arrangement can empower businesses to make informed decisions that align with their operational needs and financial goals.

Understanding the Rent To Own Model

The rent-to-own model is designed to offer businesses an alternative path to ownership. Unlike traditional leasing, where the user returns the equipment at the end of the lease term, rent-to-own agreements allow the lessee to apply rental payments towards the purchase of the loader. This model provides several advantages:

- Flexibility: Rent-to-own agreements offer customizable terms, making it easier for businesses to manage cash flow and budgetary constraints.

- Trial Period: Businesses can use this period to assess the suitability of the loader for their specific needs before committing to a purchase.

- Ownership Path: The payments made during the rental period contribute towards the purchase price, facilitating a smoother transition to ownership.

However, it is essential to scrutinize the terms of the agreement, including interest rates and the total cost of ownership, to ensure that the arrangement is financially beneficial in the long run.

Benefits of Rent To Own Loaders

Rent-to-own loaders offer a range of benefits that make them an attractive option for many businesses. These include:

- Cost-Effectiveness: By spreading the cost over time, businesses can avoid the significant upfront expenditure associated with purchasing new equipment.

- Access to Advanced Technology: Regular upgrades are possible, allowing businesses to utilize the latest technology without the need for frequent large-scale investments.

- Reduced Maintenance Burden: Many rent-to-own agreements include maintenance services, reducing the operational burden on businesses.

These benefits are particularly appealing to small and medium-sized enterprises (SMEs) that may not have the capital reserves to purchase equipment outright but require access to high-quality machinery to remain competitive.

Considerations and Challenges

While rent-to-own loaders offer numerous advantages, there are important considerations and potential challenges to keep in mind:

- Total Cost of Ownership: The cumulative cost of renting to own can sometimes exceed the cost of purchasing the equipment outright if not carefully negotiated.

- Contractual Obligations: Understanding the terms and conditions, including penalties for early termination, is crucial.

- Depreciation: The value of the equipment may depreciate faster than the payoff schedule, impacting the investment’s overall worth.

Businesses should weigh these factors carefully and consider consulting with financial advisors to ensure that the rent-to-own path aligns with their long-term strategic objectives.

Conclusion: Is Rent To Own Right for You?

Rent-to-own loaders offer a compelling option for businesses seeking to balance operational flexibility with eventual ownership. By providing a structured path to acquiring essential equipment, this model can support growth and innovation while managing financial exposure. However, the decision to pursue a rent-to-own agreement should be based on a thorough analysis of the specific needs and circumstances of the business. By doing so, companies can harness the benefits of this model to enhance their capabilities and achieve their strategic goals.